Recently Bitcoin has been reaching all time price highs, whilst Monero languishes behind at less than 1% of Bitcoin’s fiat value.

Whilst I see clear value and use-cases in Monero, the market is clearly more bullish on Bitcoin currently.

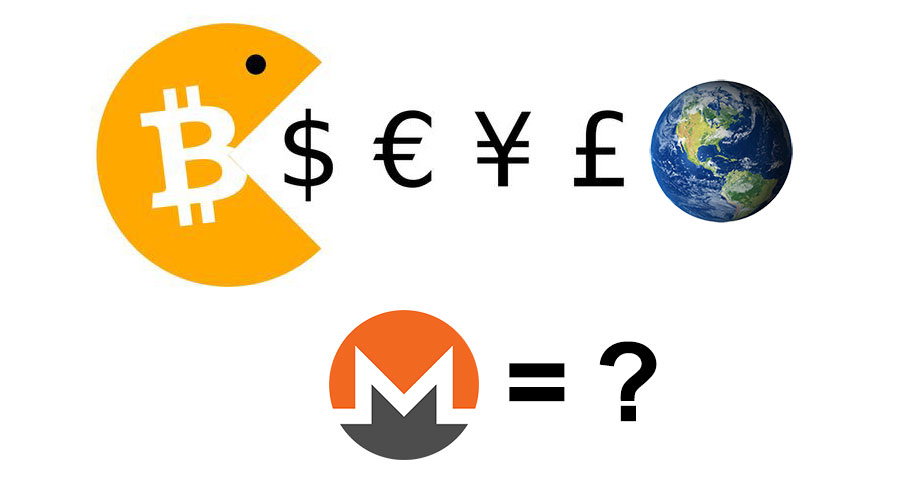

Therefore I wanted to ask myself, if things really go the direction of Bitcoin, which I see as a “worst case” (due to its lack of privacy and fungibility), is there still utility and value left in Monero?

In this post we look at a scenario where Bitcoin takes over globally, and ask how this affects Monero.

The Bitcoin Vision

To begin, let’s look at what could be “the Bitcoin vision” for the future. This is my understanding:

- Phase 1: Bitcoin goes through a price discovery phase over a number of years. Whilst its price keeps going up, it’s primarily used as a store of value, and isn’t used for daily transactions. This is where we are now.

- Phase 2: Eventually, the Bitcoin price growth starts to plateau, volatility decreases, and it becomes more logical to use it as a medium of exchange.

- Phase 3: With the price growth more stable, it’s now more logical to use Bitcoin as a medium of exchange. Bitcoin establishes itself as the dominant global settlement layer for payments. Then for day to day transactions, which the Bitcoin network is too busy and expensive to support, some combination of the below are used:

- Bitcoin second layers / sidechains

- Other cryptocurrencies

- Fiat currencies

Where could Monero fit in?

Bitcoin has a number of large flaws currently, including:

- Lack of privacy when transacting (even when you do complex and expensive coin joins, you still have less privacy than a standard Monero transaction)

- Lack of fungibility

- Lack of on-chain scalability (each block is limited ~2MB of data – which equates to around 2,600 transactions maximum per 10 minute block)

- High fees for making transactions

- Ability for miners to reject individual transactions (also known as miner censorship), using a black-list, due to the lack of fungibility

As long as these issues persist, there will be an opportunity for a decentralized currency, such as Monero, to fill the gap.

In particular, privacy and fungibility are critical for a currencies use as a medium of exchange.

The 5 items above can be thought of as a simple, but non-exhaustive checklist of features to follow in Bitcoin.

If the Bitcoin project is able to solve/ameliorate the above issues through upgrades or second layer solutions, it will gradually reduce the utility lead that Monero has over Bitcoin.

How can Bitcoin solve these 5 issues?

It’s my understanding that there are at least 2 main paths Bitcoin can take to solve these issues – network upgrades and off-chain solutions:

- Network upgrades are both the easiest, and hardest ways to improve things. Easiest, because it would solve the issues on the base layer, hardest because it requires accepting trade-offs and getting consensus from the developers and network participants.

- Off-chain solutions such as side chains and second layers are ways to abstract the transfer of Bitcoin, allowing you to later “settle” on-chain. Ultimately it’s not Bitcoin, but for many use-cases that may not matter.

- Side-chain example: Blockstream’s Liquid network is used by exchanges, who can make faster, cheaper transactions, where the amounts transferred are hidden.

- Layer 2 example: Lightning network is currently used by some online stores / betting sites to accept Bitcoin (see directory), without the high fees or slow confirmation times.

Let’s look at the subject of network upgrades in more detail.

Network Upgrades

In the past, there was a narrative in the Bitcoin community that all altcoins were testnets for Bitcoin, and if any of the altcoins found a technology that was sufficiently useful, it would be adopted on Bitcoin.

In practice however, this doesn’t appear to be happening.

For example, the idea of confidential transactions has been around for a long time, and adopted by both Monero and Blockstream’s liquid sidechain. It’s great because it hides the amounts being transacted on the blockchain. So far the idea has been rejected by the Bitcoin community, because it makes auditing the supply more difficult, and the concept of “only 21m Bitcoins” is paramount.

To audit a blockchain using confidential transactions, you can only sum up the inputs of new coinbase transactions (which is where miners find a block and get the block reward), and then you have to trust the maths that no Bitcoins were created or destroyed during transactions.

So the narrative is shifting towards the discussion of trade-offs. Meaning that Bitcoin can’t adopt all the new technology, because it has to consider the trade-offs involved. Specifically with confidential transactions, losing the ability to 100% audit the supply seems too big a trade-off.

That is likely to be the case for other potential upgrades also.

So, next let’s look at an upgrade that *does* appear to be going ahead…

Taproot

The Taproot upgrade may specifically help ameliorate issues #1 and #2 – privacy and fungibility.

It will create a new type of Bitcoin transaction called P2TR (Pay 2 Taproot). These transactions will stick out on the blockchain, compared to the existing types. However, the cool thing about it, is that all Pay 2 Taproot transactions will then look the same, whether they’re a typical 1 in 2 out, 2 in 2 out transaction, or they’re a multisig transaction. Previously if you did a multisignature transaction, it was evident on the blockchain.

This would theoretically allow you to use a privacy enhancing protocol such as CoinSwap (which utilizes multisig) and an observer would not be able to discern on the blockchain that the transaction used multisig.

My guess is that this is only a partial privacy solution, and will still be far inferior to a regular Monero transaction. But I’m keen to keep learning and see what comes of it.

Off Chain Solutions

I’ve yet to see an off-chain Bitcoin solution that substantially enhances privacy and fungibility – but they may be coming.

For example, Blockstream’s Liquid network is too centralised to be considered private.

For now, the main thing off-chain solutions improve are the issues of poor on-chain scalability (#3) and high on-chain fees (#4). They do so by offering faster transaction confirmations, at lower fees.

Conclusion

I started this thought experiment with some concern that Monero may be squeezed out by Bitcoin.

However, after looking at what Monero does better than Bitcoin, and surveying the Bitcoin landscape for solutions, I currently think that Monero is in a strong position to survive.

Going forward I will keep the above 5 issues in mind, and try to keep tabs on how Bitcoin is addressing them.

Currently I hold a small position in Monero, and thus have a financial interest in it surviving. But I’m aware that bag holding leads to tribalism, that can be a net negative for society and the cryptocurrency community overall.

Ideally we should be focused on creating good, working solutions to problems, and not be distracted about where those solutions come from.

Therefore, personal interests aside, if Bitcoin can actually solve these issues, then that’s a good thing for humanity as a whole.